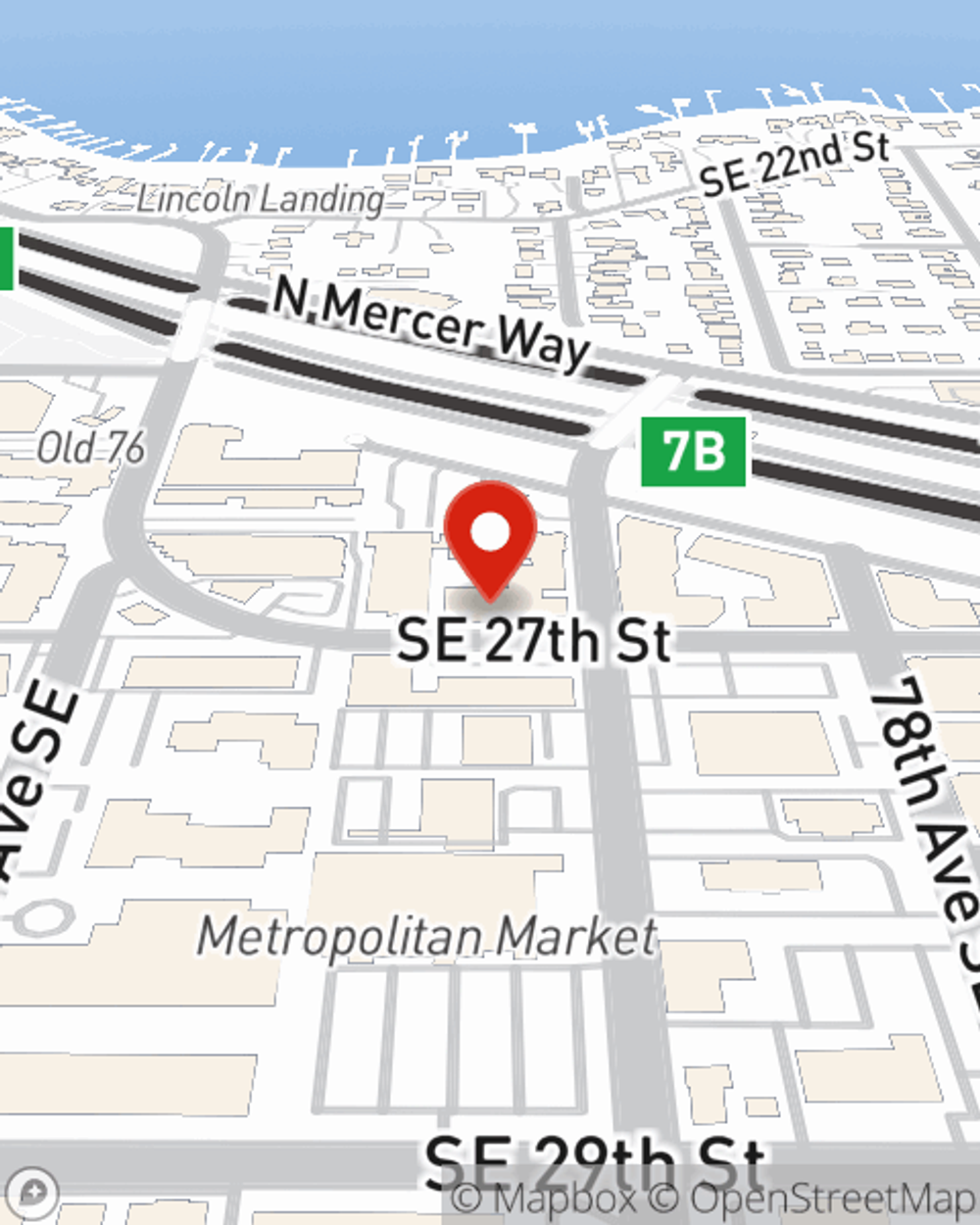

Business Insurance in and around Mercer Island

Looking for small business insurance coverage?

This small business insurance is not risky

- Mercer Island

- Seattle

- Bellevue

- King County

- Pierce County

- Snohomish

- Kitsap

- mason

- Thurston

- Skagit

- multnomah

Your Search For Excellent Small Business Insurance Ends Now.

Running a small business is no joke. Insuring your venture should be the least of your worries. State Farm insures small businesses that fall under the umbrella of specialized professions, trades, retailers and more!

Looking for small business insurance coverage?

This small business insurance is not risky

Customizable Coverage For Your Business

Your small business is unique and faces specific challenges. Whether you are growing a camera store or a candy store, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your product, you may need more than just business property insurance. State Farm Agent Tim Cashman can help with errors and omissions liability as well as commercial auto insurance.

The right coverages can help keep your business safe. Consider calling or emailing State Farm agent Tim Cashman's office today to learn about your options and get started!

Simple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Tim Cashman

State Farm® Insurance AgentSimple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.