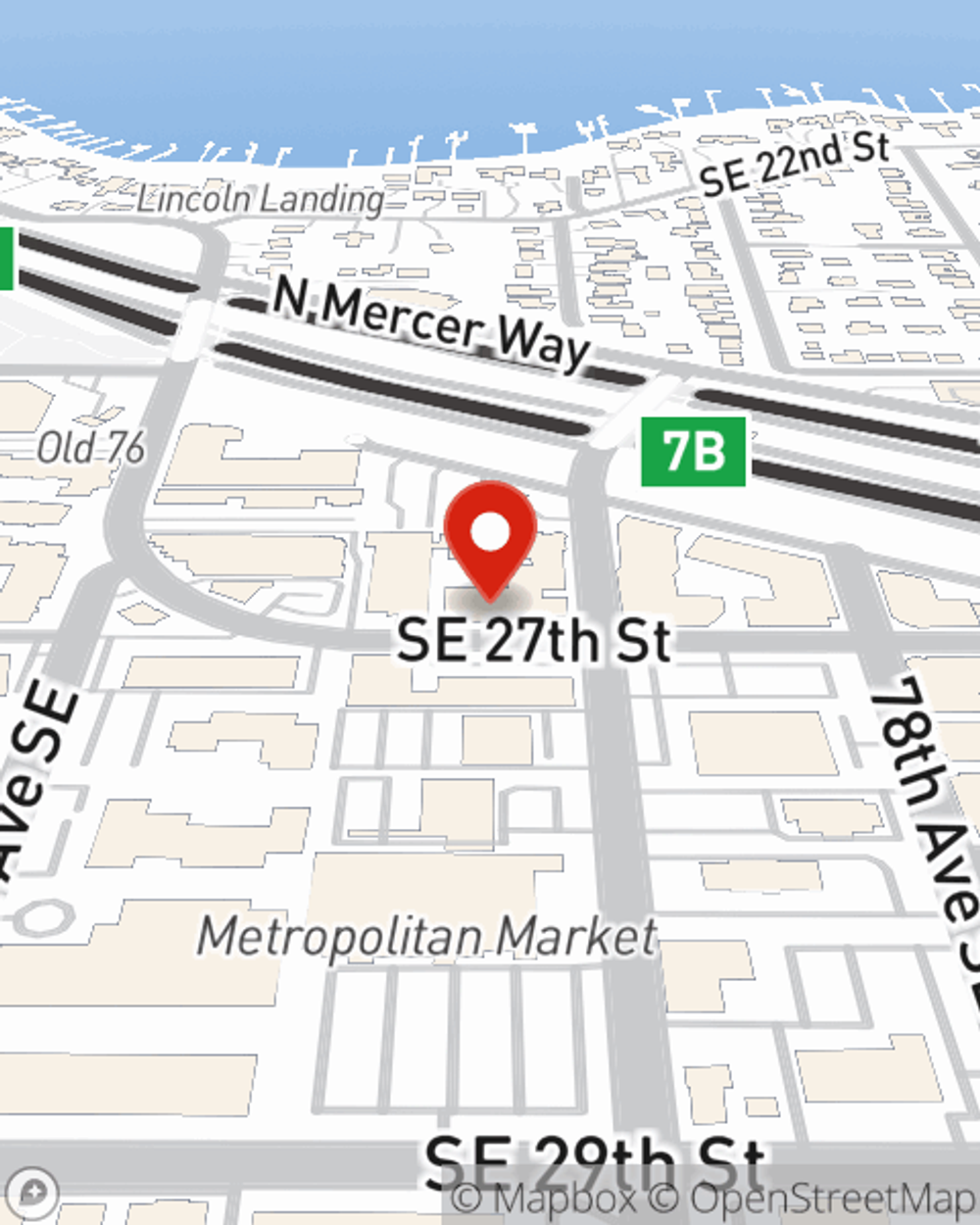

Homeowners Insurance in and around Mercer Island

If walls could talk, Mercer Island, they would tell you to get State Farm's homeowners insurance.

Help cover your home

Would you like to create a personalized homeowners quote?

- Mercer Island

- Seattle

- Bellevue

- King County

- Pierce County

- Snohomish

- Kitsap

- mason

- Thurston

- Skagit

- multnomah

Home Is Where Your Heart Is

There are plenty of choices for home insurance in Mercer Island. Sorting through coverage options and providers can be overwhelming. But if you want great priced homeowners insurance, choose State Farm. Your friends and neighbors in Mercer Island enjoy remarkable value and hassle-free service by working with State Farm Agent Tim Cashman. That’s because Tim Cashman can walk you through the whole insurance process, step by step, to help ensure you have coverage for your home as well as videogame systems, linens, sports equipment, furniture, and more!

If walls could talk, Mercer Island, they would tell you to get State Farm's homeowners insurance.

Help cover your home

State Farm Can Cover Your Home, Too

That’s why your friends and neighbors in Mercer Island turn to State Farm Agent Tim Cashman. Tim Cashman can explain your liabilities and help you make sure your bases are covered.

Let us help with the details of protecting your belongings with State Farm's excellent homeowners insurance. All you need to do to get a quote is call or email Tim Cashman today!

Have More Questions About Homeowners Insurance?

Call Tim at (206) 232-1024 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Tips to minimize moisture in your home

Tips to minimize moisture in your home

Protect your home by eliminating excess moisture before it causes major damage. These tips on moisture resistance can help.

How to use your hand tools more safely

How to use your hand tools more safely

Simple safety tips to help you choose and use your hand tools before you start your next DIY project and how to maintain them and protect yourself and others.

Tim Cashman

State Farm® Insurance AgentSimple Insights®

Tips to minimize moisture in your home

Tips to minimize moisture in your home

Protect your home by eliminating excess moisture before it causes major damage. These tips on moisture resistance can help.

How to use your hand tools more safely

How to use your hand tools more safely

Simple safety tips to help you choose and use your hand tools before you start your next DIY project and how to maintain them and protect yourself and others.